Top Insurance CRM Solution for Agents and Brokers

Insurance CRM software centralizes client information and automates routine tasks, helping agents and brokers improve efficiency and customer service.

Trusted by productive businesses all over the world

Fully customizable CRM to fit any pipeline

Fully customize your CRM to fit your workflow. No code solutions and no over the top setup costs to get started. Build it your way in no time. Easiest CRM you'll ever use.

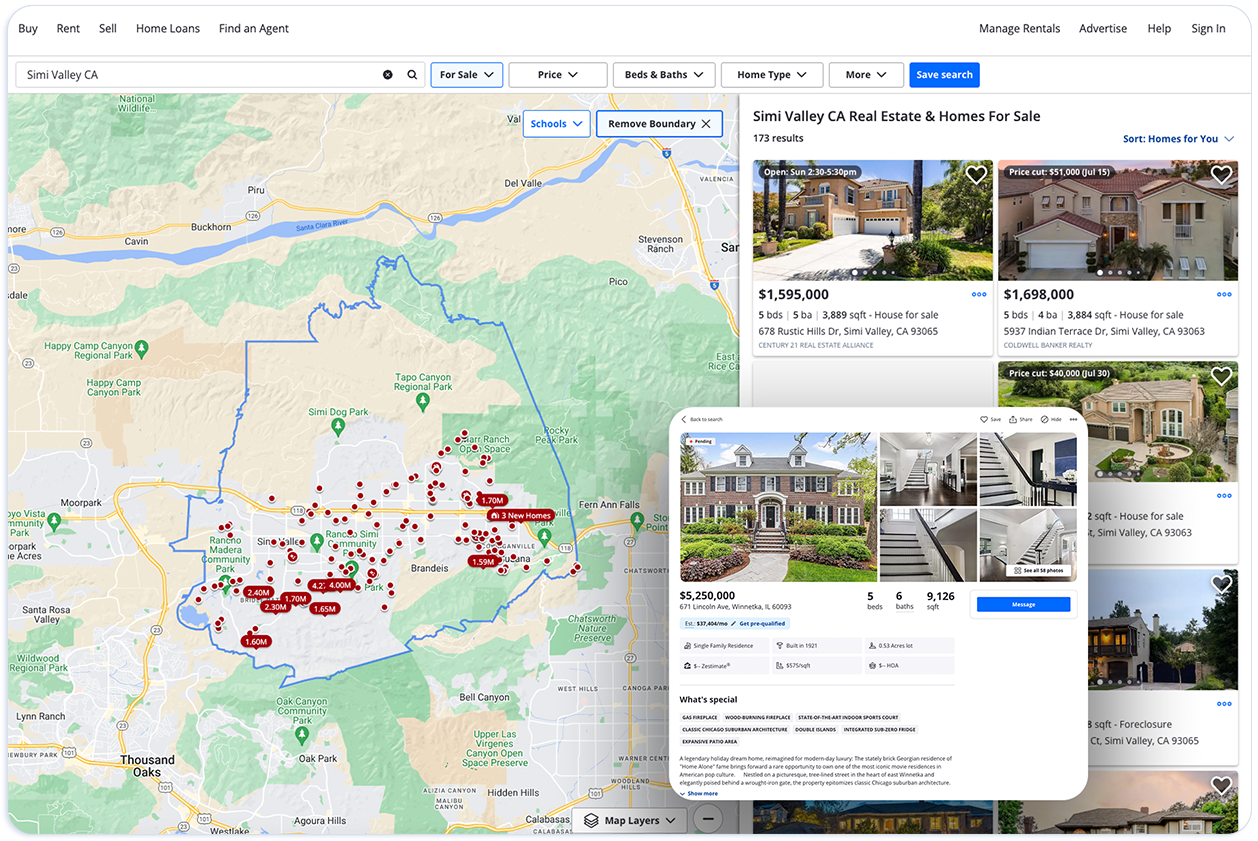

Enhance customer relations with nationwide real estate ownership data

Enhance your customer relations and boost contact enrichment with nationwide real estate ownership details.

Ai auto dialer and SMS campaigns

Improve client/customer communications with businesss VoiP software directly integrated in CRM. Make calls, record calls, send SMS message campaigns, keep track of voicemails and detailed call logs.

Draft dynamic offer letters and offering docs with one click

Save countless hours drafting offer letters with our one-click offer letter generator that is customizable to your needs and dynamic to your data.

Streamline contract signings with electronic signature solution

No need for third-party e-sign software when you have an electronic signature software directly in your CRM. Get e-sign updates on lead activity logs.

Outpace your competition and close more deals

Reduce overhead costs by reducing the number of apps you need to run your business. With all your tools in one place, move faster than ever before all while harnessing the power of A.i.

Ai chat and Ai writing tools

Save time and boost productivity with Ai chat, real-time direct messaging between team members, Ai text generator and Ai tools to take your team communication to the next level

Learn More About Other Supported Industries

Try our other free Ai tools to help you achieve a more productive worklife balance

Top Insurance CRM Solution for Agents and Brokers

Insurance CRM software centralizes client information and automates routine tasks, helping agents and brokers improve efficiency and customer service. If you’re looking to streamline operations and better manage client relationships, this guide explores the essential features and top options available.

Understanding Insurance CRM Software

Insurance CRM software is a specialized tool designed to help insurance agents and brokers manage their customer relationships more effectively. At its core, it serves as a centralized database that consolidates all client information, from contact details to transaction histories and claims requests, making it easier to manage large volumes of customer data. This centralization is crucial for insurance agencies, as it simplifies the management of customer relationships and streamlines operations, especially when using a CRM for insurance.

One of the critical functionalities of insurance CRM systems is their ability to automate various tasks, such as lead generation, customer interaction management, and sales and marketing processes. This automation allows agents to focus more on building client relationships and less on administrative work. It also includes mechanized workflows that facilitate routine tasks, ensuring timely follow-ups and service. The efficiency gained from these automated features can significantly enhance an insurance business’s overall performance.

Insurance CRM systems also provide a unified dashboard that offers comprehensive visibility into all processes within the agency. This feature boosts productivity by enabling easy navigation and quick access to essential information. Additionally, inbuilt calling features allow agents to make calls directly from the application, further simplifying communication with clients. These tools ensure that customer interactions are seamless and efficient, contributing to better customer service and satisfaction.

Furthermore, modern CRM systems integrate with social media analytics and synchronize data across various devices, ensuring that agents have access to real-time customer information at all times. This integration helps insurance businesses gauge customer sentiments and identify potential fraud, adding another layer of value to the CRM system. By leveraging these advanced features, insurance agencies can stay ahead in the competitive market, making CRM software an indispensable tool in the insurance sector.

Key Features of Insurance CRM Systems

A comprehensive insurance CRM system should offer robust policy and client management capabilities, enabling agents to update policies from anywhere and notify customers about changes. This feature ensures that all policy details are up-to-date and readily accessible, which is essential for efficient client management and service delivery.

Claims management is another critical feature of insurance CRMs. These systems are designed to track customer claims efficiently, automate claims processing, and manage the necessary documentation. This automation not only speeds up the claims process but also reduces the likelihood of errors, ensuring a smoother experience for both the agent and the client.

Lead and opportunity tracking features are vital for any CRM, and insurance CRMs are no exception. These tools help agents manage potential clients, monitor sales pipelines, and allocate leads effectively. By notifying agents when to contact leads and tracking all interactions, CRM systems ensure that no opportunity is missed. This functionality is crucial for maintaining a steady flow of new business and nurturing existing client relationships.

Analytics and reporting capabilities within insurance CRM systems provide valuable insights into fraud detection and risk prevention. These features enable insurance companies to analyze patterns and trends, helping them make informed decisions and manage risks more effectively. With a user-friendly dashboard that summarizes important information, CRM systems enhance productivity and facilitate better decision-making across the organization.

Benefits of Using Insurance CRM for Agencies

The adoption of insurance CRM software brings numerous benefits to an insurance agency, revolutionizing the way they operate. These benefits include enhanced sales processes, improved customer service, and effective risk management.

CRM best practices enable insurance agencies to enhance their sales performance, customer retention, and overall operational efficiency.

Enhanced Sales Process

Insurance CRM systems enhance sales performance by providing a clear view of client profiles and ongoing sales activities, allowing agents to predict future sales and identify patterns that reveal sales opportunities. This data-driven approach helps agents focus their efforts on the most promising leads and tailor their sales strategies accordingly.

Lead nurturing is another area where insurance CRMs shine. By capturing and continuously nurturing leads, these systems ensure that sales agents have a steady stream of prospects to engage with. CRM dashboards assist in visualizing close ratios, deal aging, and producer success, which helps sales agents stay on top of their activities and close deals more efficiently.

Additionally, insurance CRMs help identify upsell and cross-sell opportunities by analyzing client data and identifying potential needs. This capability enables agents to offer relevant products and services to their existing clients, increasing revenue and strengthening client relationships. The intuitive and customizable nature of these platforms further enhances operational efficiency for insurance brokers.

Improved Customer Service

Quick access to client records is a significant advantage of using insurance CRM software. By having all the relevant client information, such as contact details, policy specifics, and billing history, readily available, agents can provide faster and more effective service. This access ensures that customer interactions are smooth and that agents can resolve issues promptly, leading to higher customer satisfaction.

Automating customer service tasks through CRM software enhances efficiency and reduces response times. Features like automated reminders and follow-ups ensure that client communication is consistent and reliable, which significantly improves the overall customer experience. Utilizing CRM software allows insurance agents to deliver fast, affordable, and personalized service, ultimately building stronger customer relationships and trust.

Effective CRM usage also hinges on comprehensive training for all potential users. Continuous training ensures that employees can navigate the system efficiently and take full advantage of its features. Providing resources like webinars and on-demand courses can engage insurance staff during training and improve retention of information, thereby maximizing the CRM’s potential.

Risk Management

Insurance CRM systems play a crucial role in risk management by analyzing customer data and public records to assess risk accurately. Automated underwriting processes within these systems reduce human errors and create a consistent scoring system, ensuring that risk assessments are both accurate and efficient.

Document management capabilities within a CRM help insurance agencies stay compliant with industry regulations by organizing essential documents and contracts. This functionality ensures that all necessary paperwork is in order and easily accessible, which is crucial for maintaining regulatory compliance.

The appropriate insurance CRM software helps reduce the risk of unauthorized access. It also decreases the chances of data manipulation. Robust security measures within CRM systems protect sensitive client information, ensuring only authorized personnel can access critical data.

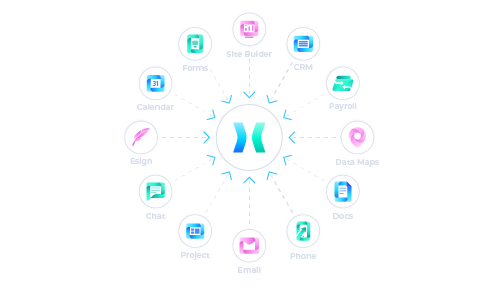

Top Insurance CRM Solution: Halsell CRM

Among the myriad of insurance CRM solutions available, Halsell CRM stands out for its suite of productivity apps tailored specifically for the insurance industry. Halsell CRM provides a comprehensive platform that integrates all necessary features, including lead management, policy tracking, and customer interaction tools.

Its user-friendly interface and customizable dashboards make it an ideal choice for insurance agents and brokers looking to enhance their operational efficiency and client service.

Implementation and Best Practices

Implementing a CRM system goes beyond software installation, requiring careful planning and adherence to best practices. Standardizing business processes and forms to comply with industry regulations promotes regulatory compliance and ensures effective CRM use.

Setting Up Your CRM

Setting up an insurance CRM involves straightforward steps to meet the team’s needs, including integrating existing data to enhance accessibility and usability. Proper data integration ensures organized and easily accessible client information, which is vital for effective CRM use.

Tracking team activities within the CRM ensures tasks are completed promptly and sales efforts are well-organized. Monitoring these activities helps managers confirm the CRM system is used effectively and the team meets performance goals.

Training Your Team

Training all potential users ensures they can navigate the CRM system efficiently and utilize its full range of features. Well-trained users take full advantage of the CRM’s tools, leading to improved sales processes and customer service.

Ongoing training helps users adapt to updates and new features, reinforcing adoption and satisfaction. Continuous training keeps employees up-to-date with the latest functionalities, enabling them to leverage the CRM system fully.

Frequently Asked Questions

What is the primary function of insurance CRM software?

The primary function of insurance CRM software is to effectively manage customer relationships by consolidating client information, streamlining operations, and automating routine tasks. This enhances efficiency and improves customer service.

How can insurance CRM systems improve customer service?

Insurance CRM systems enhance customer service by offering quick access to client records and automating tasks, leading to personalized interactions that significantly boost customer satisfaction.

What are some key features to look for in an insurance CRM system?

When selecting an insurance CRM system, prioritize features like policy and client management, claims management, lead tracking, document management, and strong analytics. These functionalities are essential for enhancing operational efficiency and improving client relationships.

How does CRM software help in risk management for insurance agencies?

CRM software enhances risk management for insurance agencies by analyzing customer data for better decision-making, automating key processes, ensuring regulatory compliance, and safeguarding sensitive client information. This comprehensive approach minimizes risks and strengthens overall operational integrity.

Why is training important when implementing a CRM system?

Training is essential for users to effectively navigate the CRM system and leverage its features, ultimately enhancing sales processes and customer satisfaction. Investing in training promotes a smoother implementation and maximizes the benefits of the CRM system.

Start Monday Off Right with the Most Robust CRM Platform

We push feature updates and deployments weekly with many new products on the horizon

Ai Agents

Voice Ai Agents

Conversational Ai Agents that speak like a human

More

Ai CRM

Ai CRM

More

Voip

Calling & Texting

Call and send SMS messages to customers with detailed call logs

More

Ai Voip

Ai Auto Dialer

Automate outbound and inbound calls with Ai power dialer

More

Docs

Docs Generator

Create custom dynamic offer letters and reports with one click

More

Tasks

Assignments

Assign leads to a team member to keep track of responsibilities

More

Team

Roles & Permissions

Access roles and permissions controls per team member

More

Scheduling

Start and Due Dates

Stay on schedule with start and due reminders to keep track of leads

More

Flexibility

Custom Fields

Build your own CRM with custom columns and custom fields

More

Esign

Electronic Signatures

Create, send and track electronic signature requests on agreements

More

Email Campaigns

Create and schedule bulk email campaigns

More

Data

Contact Enrichment

Easily obtain the contact info of contacts and leads directly in CRM

More

Ready to take your deal flow to the next level?

Sign up today for free - no credit card required