Best Financial Services CRM Solution for Optimizing Client Relationships

A Financial Services CRM (Customer Relationship Management) system is essential for financial institutions looking to build strong client relationships and streamline their operations.

Trusted by productive businesses all over the world

Fully customizable CRM to fit any pipeline

Fully customize your CRM to fit your workflow. No code solutions and no over the top setup costs to get started. Build it your way in no time. Easiest CRM you'll ever use.

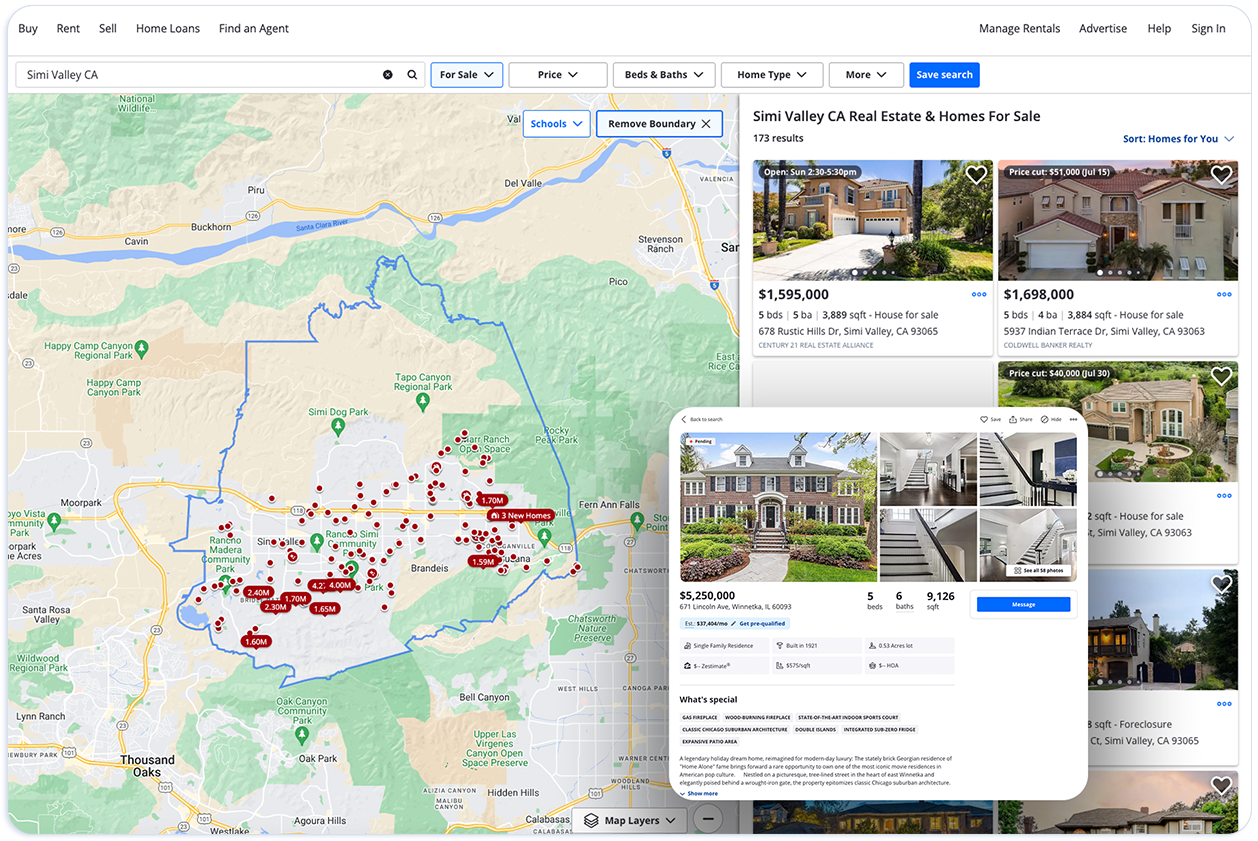

Enhance customer relations with nationwide real estate ownership data

Enhance your customer relations and boost contact enrichment with nationwide real estate ownership details.

Ai auto dialer and SMS campaigns

Improve client/customer communications with businesss VoiP software directly integrated in CRM. Make calls, record calls, send SMS message campaigns, keep track of voicemails and detailed call logs.

Draft dynamic offer letters and offering docs with one click

Save countless hours drafting offer letters with our one-click offer letter generator that is customizable to your needs and dynamic to your data.

Streamline contract signings with electronic signature solution

No need for third-party e-sign software when you have an electronic signature software directly in your CRM. Get e-sign updates on lead activity logs.

Outpace your competition and close more deals

Reduce overhead costs by reducing the number of apps you need to run your business. With all your tools in one place, move faster than ever before all while harnessing the power of A.i.

Ai chat and Ai writing tools

Save time and boost productivity with Ai chat, real-time direct messaging between team members, Ai text generator and Ai tools to take your team communication to the next level

Learn More About Other Supported Industries

Try our other free Ai tools to help you achieve a more productive worklife balance

Top Financial Services CRM Software for Optimizing Client Relationships

A Financial Services CRM (Customer Relationship Management) system is essential for financial institutions looking to build strong client relationships and streamline their operations. This article explores what a financial services CRM is, why it’s crucial for the industry, and the key features to look for in a CRM solution.

Understanding Financial Services CRM

A Financial Services CRM for financial services in the financial industry is a game-changer. This specialized software tracks interactions, manages relationships, streamlines processes, and ensures compliance. Its main goal is to help financial advisors build and maintain robust customer relationships, crucial in an industry where trust and personalized service are key.

Without a CRM system, financial services organizations often struggle to meet customer expectations and provide tailored financial advice. This can hinder effective management of client interactions, ultimately affecting customer satisfaction and retention.

Implementing a CRM system transforms how financial service providers interact with their clients, ensuring timely services and personalized experiences. A well-implemented financial CRM simplifies everyday tasks, enhances client management processes, and offers valuable insights into customer relationships and financial history.

Key Features of Financial CRM Software

Financial CRM software offers features designed to optimize client relationships and enhance operational efficiency. Key aspects include robust contact management, sales automation, and stringent security and compliance measures. These functionalities meet the unique needs of the financial services industry, enabling effective customer data management, task automation, and information security. Additionally, finance crm solutions provide tailored tools for managing client interactions.

Contact Management

Contact management is the cornerstone of effective financial CRM software. This feature organizes client data and tracks interactions across various channels like email, phone calls, and social media, offering financial advisors a holistic view of client interactions for better relationship management and personalized service.

A comprehensive financial CRM allows customization of contact management fields, enhancing the ability to track specific client data. This aids in service delivery and streamlines sales pipeline management, lead management, and overall client management. The consolidation of interactions in a robust system significantly boosts customer satisfaction and retention.

Sales Automation

Sales automation is a pivotal feature in financial CRM software, streamlining routine tasks within the sales process. Automating lead nurturing campaigns and marketing communication allows financial advisors to focus on strategic activities. Reducing manual data entry enables sales professionals to concentrate on higher-value tasks, boosting efficiency and productivity.

Financial CRM systems offer various sales automation tools like activity planning, follow-up reminders, and lead tracking to streamline workflows. These tools enhance the sales process and improve the effectiveness of the sales team, leading to better customer interactions and increased revenue potential.

Security and Compliance

Robust security and compliance measures are essential in the financial services industry. Financial CRM systems come with stringent security features to safeguard sensitive client data. These systems aid compliance management by securely storing information and enabling audit trails, ensuring adherence to regulations like GDPR and CCPA.

A financial CRM must keep customer data safe and secure, offering reliable platforms that protect information from breaches. Implementing robust security measures builds client trust, further enhancing customer satisfaction and retention.

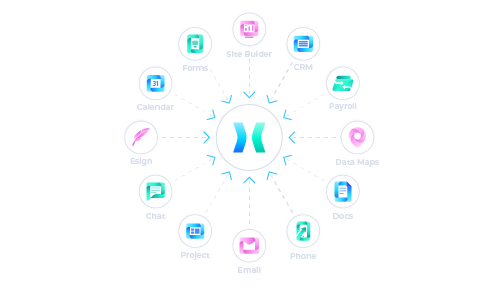

Top Financial CRM Solution: Halsell CRM

Among the many financial CRM solutions, Halsell CRM stands out. It offers a suite of productivity apps tailored to the financial services industry’s needs, including robust contact management, sales automation, and stringent security measures. This comprehensive suite ensures effective client relationship management, streamlined operations, and enhanced overall customer satisfaction.

Halsell CRM, with its user-friendly interface and extensive features, is a top choice for financial professionals aiming to optimize client relationships.

Benefits of Using CRM in Financial Services

Implementing CRM systems in financial services offers numerous benefits, including enhanced customer relationships, improved operational efficiency, and increased sales and revenue. These systems give financial service providers a comprehensive view of client accounts and transactions, streamline client acquisition processes, and automate communication efforts.

The following subsections will delve deeper into these benefits, showcasing how CRM systems can transform the financial services industry.

Enhancing Customer Relationships

CRM systems are invaluable for financial advisors in managing customer relationships. Automating follow-ups and personalizing messages significantly improve client engagement and satisfaction. Financial CRMs enable advisors to manage and analyze customer interactions, fostering stronger relationships and ensuring timely, personalized service.

Advanced data analytics in CRM systems provide deeper insights into customer preferences and behaviors, enabling more effective segmentation and tailored marketing efforts. AI-driven CRM systems analyze customer data to offer tailored financial advice and product recommendations, further enhancing client relationships and satisfaction.

By leveraging these capabilities, financial service providers can build long-term, trust-based relationships with their clients in the financial services cloud through effective wealth management.

Improving Operational Efficiency

Operational efficiency is crucial for any financial services business, and CRM systems play a pivotal role. Automating routine tasks like data entry, lead allocation, and document generation reduces manual work and minimizes errors, allowing employees to focus on higher-value activities, enhancing productivity and service delivery.

A CRM system centralizes all customer interactions, offering a comprehensive understanding of client behavior and preferences. This centralization enhances communication within the organization, ensuring all departments have access to up-to-date client information for effective collaboration. By streamlining operations and automating workflows, CRM systems improve customer satisfaction and retention, driving business growth.

Boosting Sales and Revenue

Boosting sales and revenue is a primary goal for any financial services business, and CRM systems are instrumental in achieving this. Effective sales pipeline management identifies leads and opportunities, increasing revenue potential. A good CRM facilitates lead qualification and nurturing, turning potential leads into returning customers.

CRM systems enhance lead capturing and management by allowing users to track leads and automate tedious tasks. This automation saves time and improves the effectiveness of sales teams, leading to better customer interactions and increased sales.

Additionally, CRM data informs effective cross-selling and up-selling opportunities, driving further sales growth. Implementing these strategies allows financial services businesses to significantly boost overall revenue.

Choosing the Right Financial CRM for Your Business

Choosing the right CRM system for your financial services business requires careful consideration of factors like specific business requirements, customizability, and ease of use.

The following subsections will provide detailed insights into each of these factors, helping you make an informed choice.

Identifying Business Requirements

First, clearly define your business objectives and align CRM initiatives with broader goals. Engaging key stakeholders across departments is crucial to gather comprehensive information on CRM requirements and ensure the system meets all users’ needs. Consider customization, user adoption, ease of use, security, scalability, and regulatory compliance.

Scalability ensures the CRM system can adapt to changes in your organization’s size, data volume, and feature requirements. By identifying and prioritizing these needs, you can narrow down options effectively and choose a CRM system that best supports business growth and client management.

Evaluating Customizability

Customizability is key in selecting a financial CRM, enhancing the software’s adaptability to unique business processes. It allows tailoring features and workflows to specific organizational needs, ensuring the CRM system supports unique business operations effectively.

User-friendly configuration options in CRM systems allow even non-experts to customize the software as needed. This flexibility improves user adoption and enhances client relationships by enabling personalized interactions and custom reports.

A highly customizable CRM can significantly boost customer satisfaction and experience by aligning the system with your business’s specific needs.

Considering Ease of Use

Ease of use is critical for the successful adoption of a CRM system in your organization. A user-friendly interface promotes quick adoption and reduces the learning curve for staff, making it easier for them to use the system effectively. Halsell CRM is known for its ease of use and supports various business growth tools, making it suitable for financial organizations.

Choosing a CRM system with a user-friendly interface streamlines operations and enhances overall customer experience. This improves customer satisfaction and boosts employee productivity and engagement, ultimately driving business growth.

Implementing CRM in Financial Services

Implementing a CRM system in financial services involves training and support, integration with existing systems, and ongoing monitoring and evaluation. Effective implementation streamlines client interactions, aids in risk management and compliance tracking, and optimizes administrative tasks.

The following subsections will provide detailed insights into each aspect of the implementation process.

Training and Support

Ongoing training for staff is crucial for effective use of CRM systems in financial services. Proper training programs help employees understand CRM functionalities, enabling them to utilize it fully. This enhances service delivery and improves customer experience and client management.

In addition to initial training, ongoing support is essential to address issues and ensure continuous improvement in CRM usage. Comprehensive training and support help financial service providers maximize CRM benefits and achieve business objectives.

Integration with Existing Systems

Seamless integration with existing systems is vital for successful CRM implementation. Integrating the CRM with tools like accounting software, financial planning tools, and document management systems enhances connectivity and streamlines data exchange. This improves data accuracy, saves time, and eliminates human error.

Prioritizing open architecture in financial CRM systems is important for seamless integration with other applications.

Ensuring CRM integration with existing systems allows financial service providers to:

Automate processes

Enhance workflow efficiency

Improve client management

Boost overall operational performance

Monitoring and Evaluation

Monitoring and evaluation are critical components of CRM implementation in financial services. Effective performance tracking methods, such as key performance indicators (KPIs), enable firms to monitor CRM system effectiveness over time. Data analytics tools further enhance tracking of client interactions and CRM performance.

Regular feedback from clients provides qualitative insights into CRM performance, highlighting areas needing attention. Analyzing performance metrics like client satisfaction, customer retention rates, and engagement levels helps financial service providers identify patterns and make informed decisions to refine CRM processes and optimize data management.

Continuously evaluating the CRM system and making iterative improvements fosters sustained success and supports a proactive approach to client management.

Future Trends in Financial Services CRM

Emerging technologies and evolving client expectations shape the future of financial services CRM. As the financial industry embraces digital transformation, several trends are set to redefine client relationship management.

The following subsections will explore these trends, including AI and machine learning, mobile CRM, and enhanced data analytics.

AI and Machine Learning

AI and machine learning are revolutionizing CRM capabilities in the financial services industry. Predictive analytics powered by AI enables financial institutions to analyze vast amounts of customer data to identify trends and anticipate customer needs and preferences before they arise. This leads to more personalized client interactions and improved customer satisfaction.

These technologies are reshaping the landscape of financial services by enhancing CRM capabilities, allowing financial advisors to provide tailored financial advice and product recommendations. By leveraging AI and machine learning, financial service providers can automate processes, enhance customer interactions, and drive business growth.

Mobile CRM

Mobile CRM solutions are becoming increasingly important for financial professionals who need to manage client relationships while on the move. A mobile-ready CRM allows financial advisors to access client information anywhere, enhancing their capability to serve clients effectively. Research indicates that 65% of companies using mobile CRM met their sales quotas, illustrating its potential impact on sales performance.

Enhanced Data Analytics

Enhanced data analytics in financial CRM systems offer significant advancements for understanding customer behavior and improving decision-making. Insights into client behaviors and preferences can significantly impact strategy and service personalization in financial services. By leveraging advanced financial data analytics, financial service providers can gain a deeper understanding of their clients, leading to more effective marketing and customer engagement.

These analytics tools enable financial institutions to make data-driven decisions, optimize client interactions, and enhance overall customer satisfaction. As data analytics capabilities continue to evolve, they will play an increasingly critical role in shaping the future of customer relationship management in the financial services industry.

Frequently Asked Questions

What is a Financial Services CRM?

A Financial Services CRM is a specialized tool that manages client relationships, tracks interactions, and streamlines processes while ensuring compliance within the financial services sector. This software is essential for enhancing efficiency and fostering strong client connections.

How does a CRM system enhance customer relationships in financial services?

A CRM system enhances customer relationships in financial services by automating follow-ups and personalizing communication, while also providing advanced data analytics to better understand customer preferences and behaviors. This leads to more tailored interactions and increased customer satisfaction.

What are the key features to look for in a financial CRM?

When selecting a financial CRM, prioritize robust contact management, sales automation, and strong security and compliance measures. These features are essential for effective customer relationship management in the financial sector.

How important is the integration of CRM with existing systems?

The integration of CRM with existing systems is essential for enhancing workflow efficiency and improving data accuracy. It ensures seamless operations across different departments, ultimately contributing to better overall performance.

What future trends are shaping the financial services CRM landscape?

The financial services CRM landscape is being shaped by the integration of AI and machine learning, mobile CRM solutions, and advanced data analytics, which collectively enhance personalization and customer engagement. These trends will significantly improve decision-making in the industry.

Start Monday Off Right with the Most Robust CRM Platform

We push feature updates and deployments weekly with many new products on the horizon

Ai Agents

Voice Ai Agents

Conversational Ai Agents that speak like a human

More

Ai CRM

Ai CRM

More

Voip

Calling & Texting

Call and send SMS messages to customers with detailed call logs

More

Ai Voip

Ai Auto Dialer

Automate outbound and inbound calls with Ai power dialer

More

Docs

Docs Generator

Create custom dynamic offer letters and reports with one click

More

Tasks

Assignments

Assign leads to a team member to keep track of responsibilities

More

Team

Roles & Permissions

Access roles and permissions controls per team member

More

Scheduling

Start and Due Dates

Stay on schedule with start and due reminders to keep track of leads

More

Flexibility

Custom Fields

Build your own CRM with custom columns and custom fields

More

Esign

Electronic Signatures

Create, send and track electronic signature requests on agreements

More

Email Campaigns

Create and schedule bulk email campaigns

More

Data

Contact Enrichment

Easily obtain the contact info of contacts and leads directly in CRM

More

Ready to take your deal flow to the next level?

Sign up today for free - no credit card required