Best Banking CRM Software to Enhance Customer Relationships

Banking CRM systems centralize customer data, improving accessibility and efficiency in managing customer relationships, which enhances overall customer satisfaction.

Trusted by productive businesses all over the world

Fully customizable CRM to fit any pipeline

Fully customize your CRM to fit your workflow. No code solutions and no over the top setup costs to get started. Build it your way in no time. Easiest CRM you'll ever use.

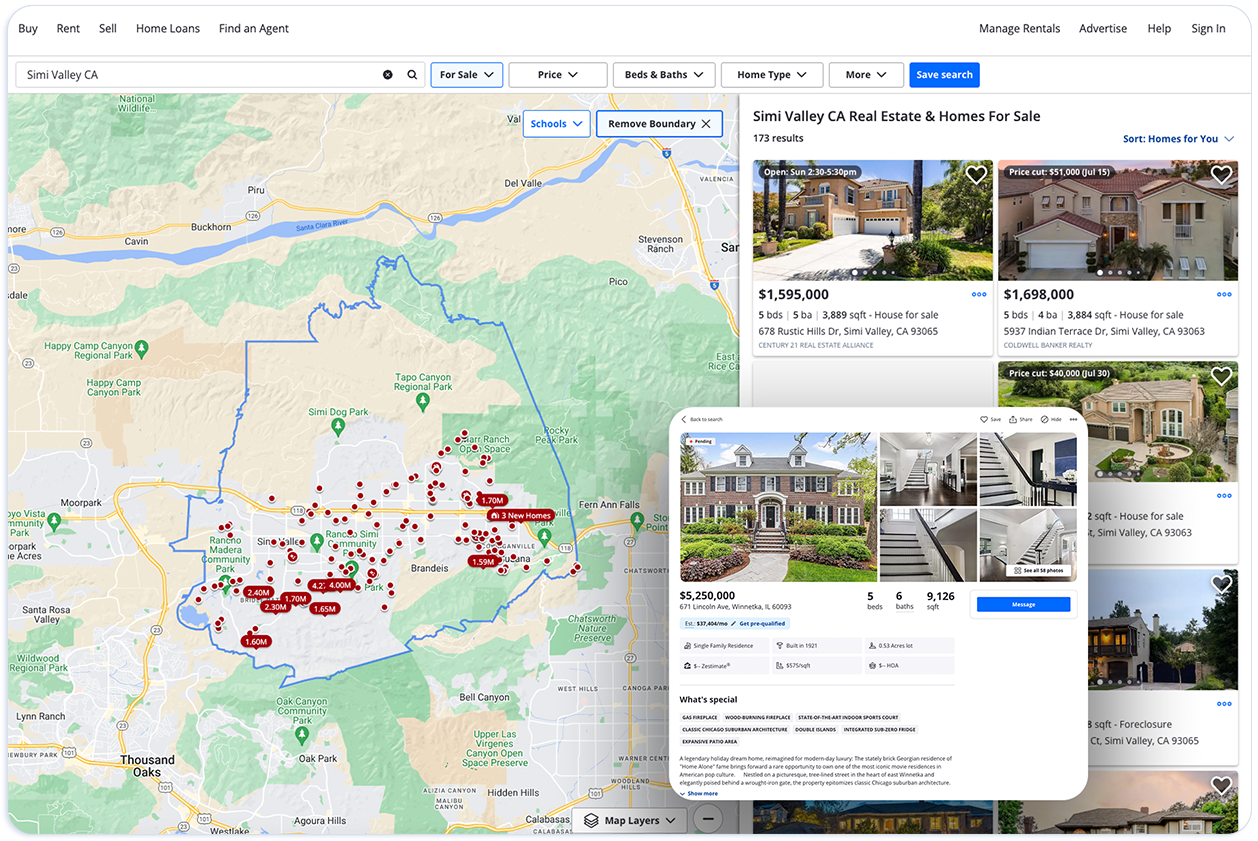

Enhance customer relations with nationwide real estate ownership data

Enhance your customer relations and boost contact enrichment with nationwide real estate ownership details.

Ai auto dialer and SMS campaigns

Improve client/customer communications with businesss VoiP software directly integrated in CRM. Make calls, record calls, send SMS message campaigns, keep track of voicemails and detailed call logs.

Draft dynamic offer letters and offering docs with one click

Save countless hours drafting offer letters with our one-click offer letter generator that is customizable to your needs and dynamic to your data.

Streamline contract signings with electronic signature solution

No need for third-party e-sign software when you have an electronic signature software directly in your CRM. Get e-sign updates on lead activity logs.

Outpace your competition and close more deals

Reduce overhead costs by reducing the number of apps you need to run your business. With all your tools in one place, move faster than ever before all while harnessing the power of A.i.

Ai chat and Ai writing tools

Save time and boost productivity with Ai chat, real-time direct messaging between team members, Ai text generator and Ai tools to take your team communication to the next level

Learn More About Other Supported Industries

Try our other free Ai tools to help you achieve a more productive worklife balance

Best Banking CRM Software to Enhance Customer Relationships

Curious how banks maintain top-notch customer relationships? Banking CRM systems are key. They centralize customer data, automate tasks, and enhance service delivery, making customers happier.

What is Banking CRM?

Banking CRM refers to specialized software designed to manage customer relationships within financial institutions. As customer expectations reach new heights, the banking industry must swiftly adapt to deliver exceptional services, maintain compliance, and achieve sustainable growth. A well-implemented banking CRM platform offers personalized services that significantly boost customer retention and satisfaction, making it an essential crm for banking.

At its core, a banking CRM system centralizes customer data, ensuring consistency and accessibility of information. This centralized data management not only improves customer relationships but also shortens resolution times, enhancing overall customer satisfaction. Imagine a scenario where a customer issue is resolved within minutes because the bank employee has instant access to all relevant customer data – this is the power of modern CRM systems.

The benefits extend further. Automating key banking processes like dispute resolution ensures consistent and efficient handling of customer issues. Additionally, robust reporting and analytics capabilities allow banks to track customer interactions meticulously, helping them manage risks and streamline operations. Thus, the adoption of banking CRM software is a strategic move for any financial institution looking to manage customer relationships more effectively.

Key Features of Modern Banking CRM Systems

Modern banking CRM systems are packed with features that make managing customer relationships more efficient and effective. One of the most significant features is centralized data management. This allows for the efficient organization and access to customer information, making it easier to deliver personalized banking services.

Artificial intelligence and machine learning tools embedded in the CRM analyze customer data to identify trends and deliver personalized financial solutions. These advanced technologies can predict customer needs and offer tailored recommendations, enhancing the customer experience.

Marketing and sales automation capabilities are another cornerstone of modern CRM systems. These tools streamline marketing campaigns and improve conversion rates by automating repetitive tasks and ensuring that the right message reaches the right customer at the right time. Such automation can turn prospects into loyal banking customers effortlessly.

Workflow automation further enhances operational efficiency by minimizing manual processes in customer-related tasks. Automating routine tasks not only saves time but also reduces the likelihood of human errors, leading to better customer service and increased productivity.

Finally, robust customer service features support effective case management and quick resolution of customer inquiries. With these tools, banks can ensure that customer service representatives have all the information they need to resolve issues swiftly, thereby improving overall customer satisfaction and loyalty.

Benefits of Implementing CRM in Banking

The implementation of CRM in banking brings a multitude of benefits, starting with increased customer retention. By delivering consistent and personalized services, banks can significantly enhance customer satisfaction and loyalty. When customers feel valued and understood, they are more likely to stay with the bank, leading to improved customer retention rates.

Moreover, CRM systems can lead to increased profitability through optimized operations. Centralizing customer data and automating processes allows banks to streamline operations and reduce costs. This efficiency translates into higher profitability and better resource allocation.

Another critical benefit is the ability to enhance cross-selling opportunities. Analyzing customer data helps banks identify needs and preferences, enabling them to offer relevant products and services. This data-driven approach not only boosts sales but also improves customer satisfaction by providing tailored solutions.

The continuous analysis of customer data also provides valuable insights that inform product and marketing strategies related to the customer journey and customer behavior. Banks can use these insights to adjust their strategies and improve their service offerings, ensuring they meet the evolving needs of their customers.

Innovative AI solutions, like chatbots and virtual assistants, further enhance customer service by providing continuous support and quick resolution of inquiries.

How to Choose the Right Banking CRM

Choosing the right banking CRM is crucial for maximizing the benefits it can offer. One of the first considerations is the customizability and integration capabilities of the CRM. Solutions like Salesforce Financial Services Cloud are highly customizable and integrate tools for sales, marketing, and support, making them versatile for various banking needs.

Scalability is another vital factor. As your bank grows, your CRM should be able to expand with it. Additionally, ensuring that the CRM complies with security standards like GDPR is essential for protecting sensitive customer data.

Evaluating the vendor’s experience in the banking sector is also crucial. Researching the vendor’s track record can help avoid integration issues and ensure a smoother implementation process. Requesting demos is a practical step to evaluate the CRM’s features and usability before making a final decision.

Budget considerations are critical as well. Establishing a clear budget that accounts for user count, data volume, and necessary functionalities will help in choosing a CRM that meets your needs without overspending. User-friendliness should also be prioritized to ensure that your staff can easily operate the system.

Why Halsell CRM is the Best Banking CRM

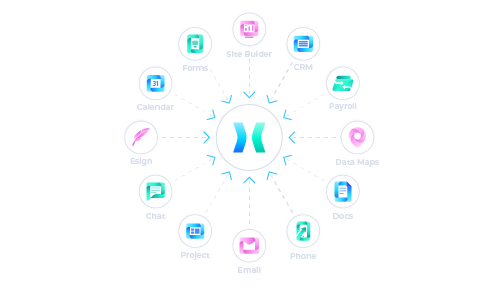

Halsell CRM distinguishes itself as the premier choice for banking CRM solutions due to its comprehensive features and user-friendly platform. It uniquely combines project management and customer relationship management into a single, cohesive system, allowing financial institutions to streamline their operations and enhance customer relationships effectively.

One of Halsell CRM's standout features is its VoIP capabilities, which enable banks to make calls and send texts directly through the browser. This functionality enhances communication efficiency, ensuring seamless interactions with customers across multiple platforms.

The platform's freemium pricing model, including a free forever plan, offers basic project management and CRM functionalities, making it an accessible choice for banks of all sizes. This model allows financial institutions to explore its features without a significant upfront investment, ensuring they find the perfect fit for their needs.

Halsell CRM also excels in marketing efforts with its bulk email campaign features, allowing banks to reach out to customers with personalized marketing campaigns efficiently. The client-side scheduling tools further enhance operational efficiency by streamlining appointment settings and reducing communication back-and-forth.

Moreover, Halsell CRM's ability to centralize customer data and automate routine tasks significantly improves customer service processes, helping banks manage customer relationships more effectively. By leveraging these advanced features, financial institutions can anticipate customer needs, deliver personalized services, and improve customer satisfaction, making Halsell CRM the best choice for banking CRM solutions.

Best Practices for Implementing CRM in Banking

Successfully implementing a CRM in banking requires following best practices. Encouraging user adoption through comprehensive training and support is crucial. Staff should be well-versed in using the CRM to maximize its benefits.

Centralizing customer data is another key practice. Centralizing all customer information ensures easy access and improves customer service. This centralization also helps in ensuring compliance with industry regulations by tracking customer interactions and storing necessary documentation.

Automation of routine tasks is essential for increasing employee productivity and reducing human errors. Automating repetitive tasks leads to greater operational efficiency and cost savings. Real-time access to data further enhances productivity and responsiveness to customer needs.

Finally, leveraging AI-driven automation can significantly enhance customer service processes. Banks should examine their needs, customize the CRM solution accordingly, train their staff, and ensure seamless integration with existing technologies.

Success Stories of CRM in Banking

Many financial institutions have successfully implemented CRM systems, resulting in significant improvements in customer relationships and operational efficiency. Citigroup improved customer satisfaction and loyalty by unifying customer data and automating manual processes. Prudential Financial enhanced its sales performance by using CRM to streamline sales processes and improve customer interactions.

Similarly, Vanguard Group utilized CRM to personalize investment strategies and customer profiles, leading to higher client satisfaction and better retention rates. American Express leveraged CRM to integrate customer data from multiple sources, enhancing its loyalty programs and improving customer service.

JPMorgan Chase also saw benefits by consolidating client information through a sophisticated CRM system, enhancing client communication and operational efficiency. Barclays improved its mortgage application processes for brokers and clients, showcasing efficiency gains through CRM.

PenFed leveraged AI and omnichannel support to help members fulfill their financial aspirations, demonstrating the power of personalized services.

Future Trends in Banking CRM

The future of banking CRM is being shaped by several emerging trends. Predictive analytics powered by AI are helping banks anticipate customer behaviors and proactively address their needs. This capability allows for a more personalized customer service experience.

Blockchain technology is enhancing data integrity and security within banking CRM systems. By decentralizing financial transaction data, blockchain ensures transparency and trust, which are crucial in the banking sector.

Open banking is another trend that allows banks to share customer data with third parties securely, enhancing access to varied financial products and fostering competition. Cloud computing is also being adopted to improve scalability, lower costs, and enhance data protection.

Integrated omnichannel communication ensures seamless customer interactions across various platforms, while real-time interaction capabilities allow banks to engage in customer engagement promptly with tailored recommendations. These trends are transforming how institutions engage with customers and manage relationships.

Best Banking CRM: Halsell CRM

Halsell CRM stands out as one of the best banking CRM solutions available. It integrates both project management and customer relationship management into a single platform, allowing users to manage multiple aspects of their business efficiently.

The platform supports VoIP capabilities, enabling users to make calls and send texts directly through the browser. Halsell also offers a freemium pricing model, including a free forever plan that provides basic project management and CRM functionalities.

Additionally, Halsell CRM includes features for bulk email campaigns, enhancing marketing efforts for banks and financial institutions. Client-side scheduling tools help streamline appointment setting, reducing communication back-and-forth and improving overall efficiency.

Frequently Asked Questions

What is Banking CRM?

Banking CRM is a specialized software that centralizes customer data and automates processes in financial institutions, ultimately enhancing service delivery and customer satisfaction.

What are the key features of modern banking CRM systems?

Key features of modern banking CRM systems encompass centralized data management, AI and machine learning tools, marketing and sales automation, workflow automation, and enhanced customer service capabilities. These functionalities work together to improve customer interactions and operational efficiency.

How does CRM benefit banks?

CRM benefits banks by increasing customer retention and profitability, optimizing operations, enhancing cross-selling opportunities, and offering valuable insights for strategic adjustments. These advantages enable banks to foster stronger relationships with their clients and improve overall performance.

What should banks consider when choosing a CRM?

Banks should prioritize customizability, integration capabilities, scalability, and security compliance when selecting a CRM to ensure it meets their specific needs and regulatory requirements. Additionally, evaluating vendor experience, budget constraints, and user-friendliness is critical for successful implementation.

What are some success stories of CRM implementation in banking?

Successful CRM implementations in banking, such as those by Citigroup and American Express, demonstrate significant improvements in customer satisfaction and enhanced loyalty programs through the unification and integration of customer data. These examples underscore the effectiveness of a well-executed CRM strategy in driving success.

Start Monday Off Right with the Most Robust CRM Platform

We push feature updates and deployments weekly with many new products on the horizon

Ai Agents

Voice Ai Agents

Conversational Ai Agents that speak like a human

More

Ai CRM

Ai CRM

More

Voip

Calling & Texting

Call and send SMS messages to customers with detailed call logs

More

Ai Voip

Ai Auto Dialer

Automate outbound and inbound calls with Ai power dialer

More

Docs

Docs Generator

Create custom dynamic offer letters and reports with one click

More

Tasks

Assignments

Assign leads to a team member to keep track of responsibilities

More

Team

Roles & Permissions

Access roles and permissions controls per team member

More

Scheduling

Start and Due Dates

Stay on schedule with start and due reminders to keep track of leads

More

Flexibility

Custom Fields

Build your own CRM with custom columns and custom fields

More

Esign

Electronic Signatures

Create, send and track electronic signature requests on agreements

More

Email Campaigns

Create and schedule bulk email campaigns

More

Data

Contact Enrichment

Easily obtain the contact info of contacts and leads directly in CRM

More

Ready to take your deal flow to the next level?

Sign up today for free - no credit card required